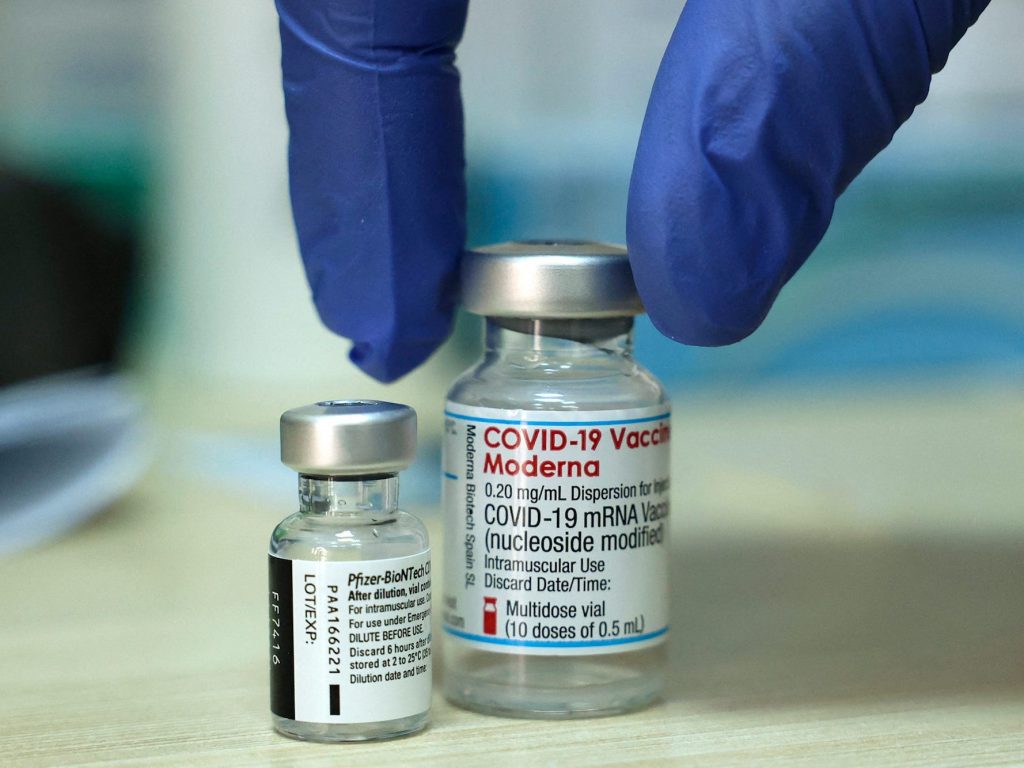

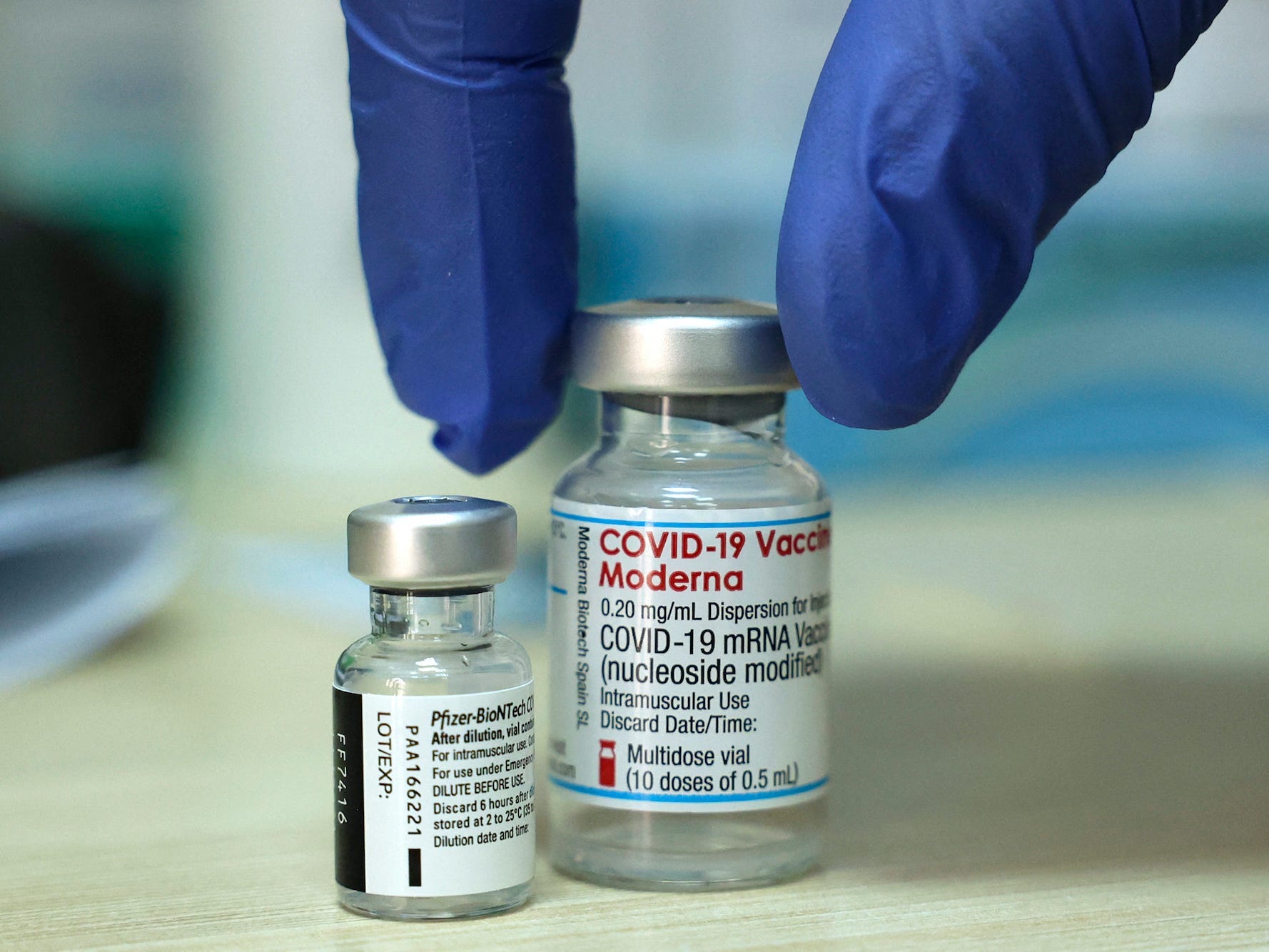

HAZEM BADER/AFP via Getty Images

Welcome to 10 Things Before the Opening Bell.

If this was forwarded to you, sign up here. Plus, download Insider's app for news on the go – click here for iOS and here for Android.

Let's jump in.

1. Global stocks follow US markets higher after FDA approval of COVID-19 vaccine. Pfizer became the first vaccine manufacturer to receive full approval, and shares jumped in response. Investors anticipate this will lead to a continued reopening of the economy. See the latest from crypto to oil on the markets.

2. China's stock sell-off caught US hedge funds off-guard, says Goldman Sachs. Overseas regulatory crackdowns have sent Chinese tech stocks plummeting, and long exposure to those stocks made firms vulnerable. Recent stock losses have been large and abrupt – and some US hedge funds paid the price.

3. Retail investors listen up: These meme stocks have huge short-squeeze potential this week. Data provider Fintel identified five heavily shorted stocks including Virpax Pharmaceuticals - see their full list here.

4. Earnings on deck: Best Buy, Nordstrom, and Toll Brothers, all reporting.

5. Richard Branson's Virgin Orbit is going public in a SPAC merger. The billionaire's satellite launch company is valued at $3.2 billion, and aims to have shares listed on Nasdaq. Get the view from the ground on what's going on in the space company.

6. The president of El Salvador says the country is installing bitcoin ATMs ahead of its adoption as legal currency. The millennial president emphasized no one will be forced to use bitcoin - this is why he sees this as legislation for financial inclusion and economic growth.

7. Mark Cuban agrees with Cathie Wood's bullish take on AI - but 'Big Short' investor doesn't. The 'Shark Tank' star is buying into AI, even after Burry bet against Wood's flagship ETF. (He's also betting that interest rates are going up.) Check out what Cuban said about AI's "competitive advantage" - and why it's nowhere to be seen on the balance sheet.

8. Young traders are turning to social media for investment advice. CNBC found social media to be the advisor of choice for a third of younger investors, and 12% of respondents said they started investing because "it feels like a game." Robinhood has faced backlash from people who claim it gamified investing - get the rest of the survey data here.

9. A 20-year crypto veteran anticipates bitcoin and ether will surpass all-time highs soon. Strategist Nick Cawley credits the burgeoning institutional interest in digital currencies for fueling the rally. Here's the five cryptos Cawley's watching as he waits for the boom.

10. This CEO has seen a 487% surge in trading volume in his crypto-trading firm. More big institutions are buying into DeFi, according to Micheal Moro, and big spenders aren't only buying bitcoin. Ether has surged in popularity - this is Moro's up-and-coming crypto pick.

Compiled by Phil Rosen. Feedback? Email [email protected] or tweet @philrosenn.

Sign up for more Insider newsletters here.